Borang E 2019 Submission

Form e for the year of remuneration 2018 i submission of a complete and acceptable form e a form e shall only be considered complete if c p 8d is furnished on or before the due date for submission of the form.

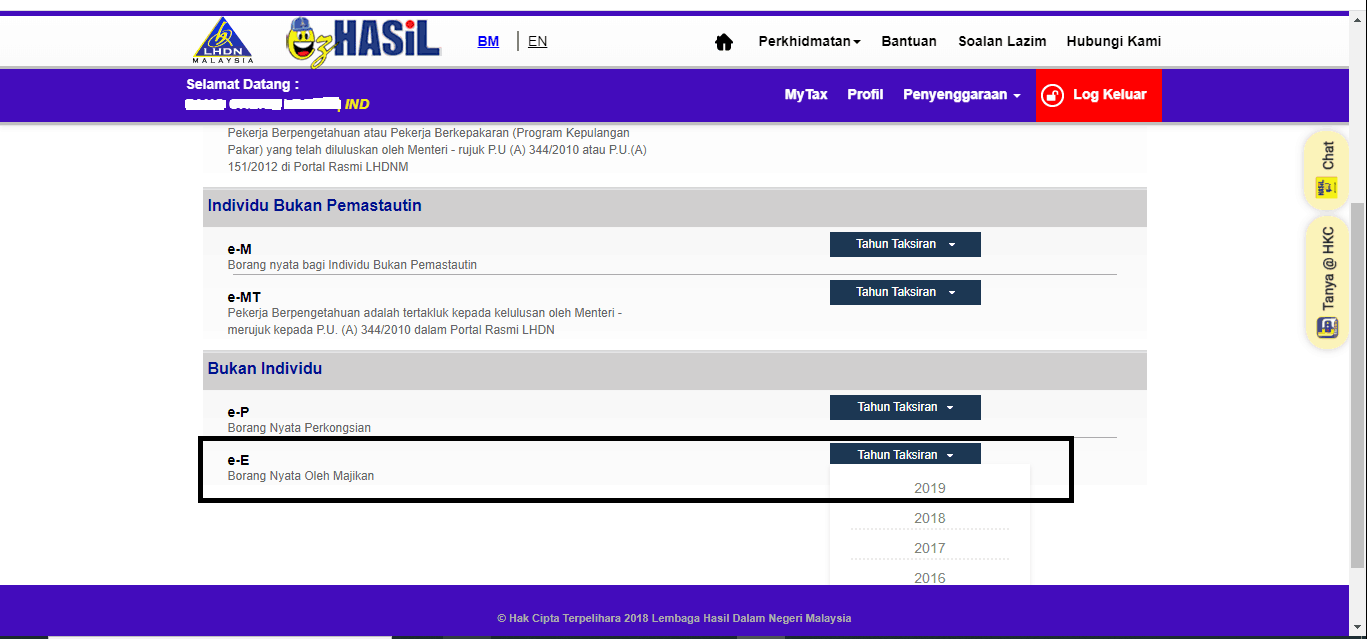

Borang e 2019 submission. Form e 2019 important. Guide notes on submission of rf 2. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. Submission of manual form by sdn bhd will be rejected by irb please read here.

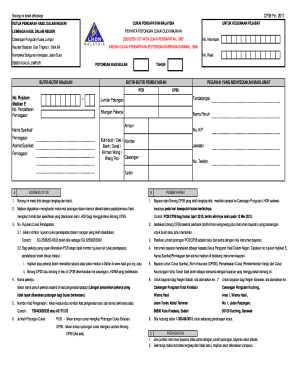

B form e and c p 8d must be submitted in accordance with the format as provided by lhdnm. Every company needs to submit your form e. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Mtd pcb schedule 2018.

Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan. What is form e. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah.

Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Nama 5 7 negeri no. Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. E borang e permohonan pindaan be.

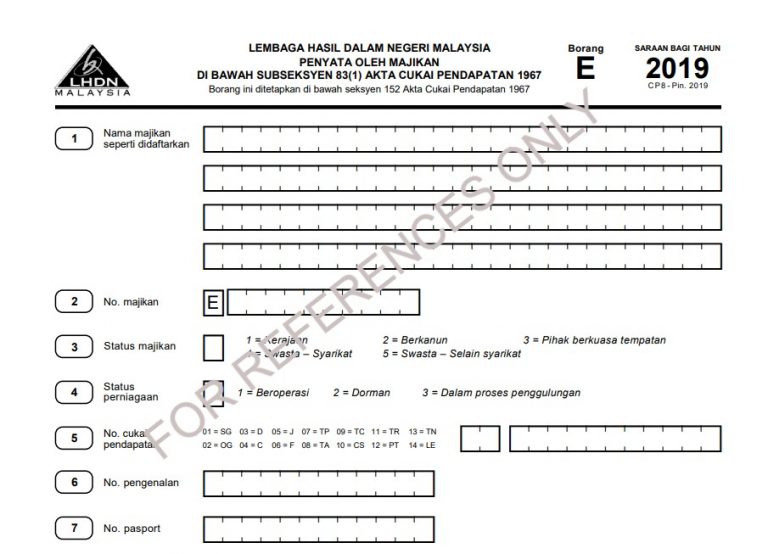

31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. 2019 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e. Irb media release for form e 2018 2.

Who needs to file the form e. Form type category due date for submission e 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker.