Borang P Income Tax

Remember you file for 2018 income tax in 2019.

Borang p income tax. For many it is a time of extra stress and anxiety especially for the first time tax payers to submit their income tax return form itrf. Borang p e p borang nyata perkongsian real partnership form. Please fill in the relevant column only or b. The due date for submission of form be 2010 is 30 april 2011.

Use the form received to make an income tax declaration. Of tax agent approval audit license akuan declaration peringatan. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020. Residents and non residents with non business income form be and m by 30 april continue reading borang tp 1 tax release form.

Change the form to form be at any of the irbm branch or you can file your income tax return form using the e filing application. Notice of appeal to the special commissioners of income tax real property gains tax act 1976 form ckht 18 pin 1 2004 this form can be downloaded and submitted to lembaga hasil dalam negeri malaysia. Income tax declaration and submission. It s that time of the year again.

Di bawah sistem taksir sendiri tuan tidak perlu mengemukakan rekod rekod perniagaan perkongsian. Borang p tersebut akan dianggap sebagai tidak lengkap dan akan dikembalikan semula kepada tuan untuk diisi dengan lengkap. After clicking on e borang then you will be shown a list of income tax forms. If you are an individual with non business income choose income tax form be e be and choose the assessment year tahun taksiran 2018.

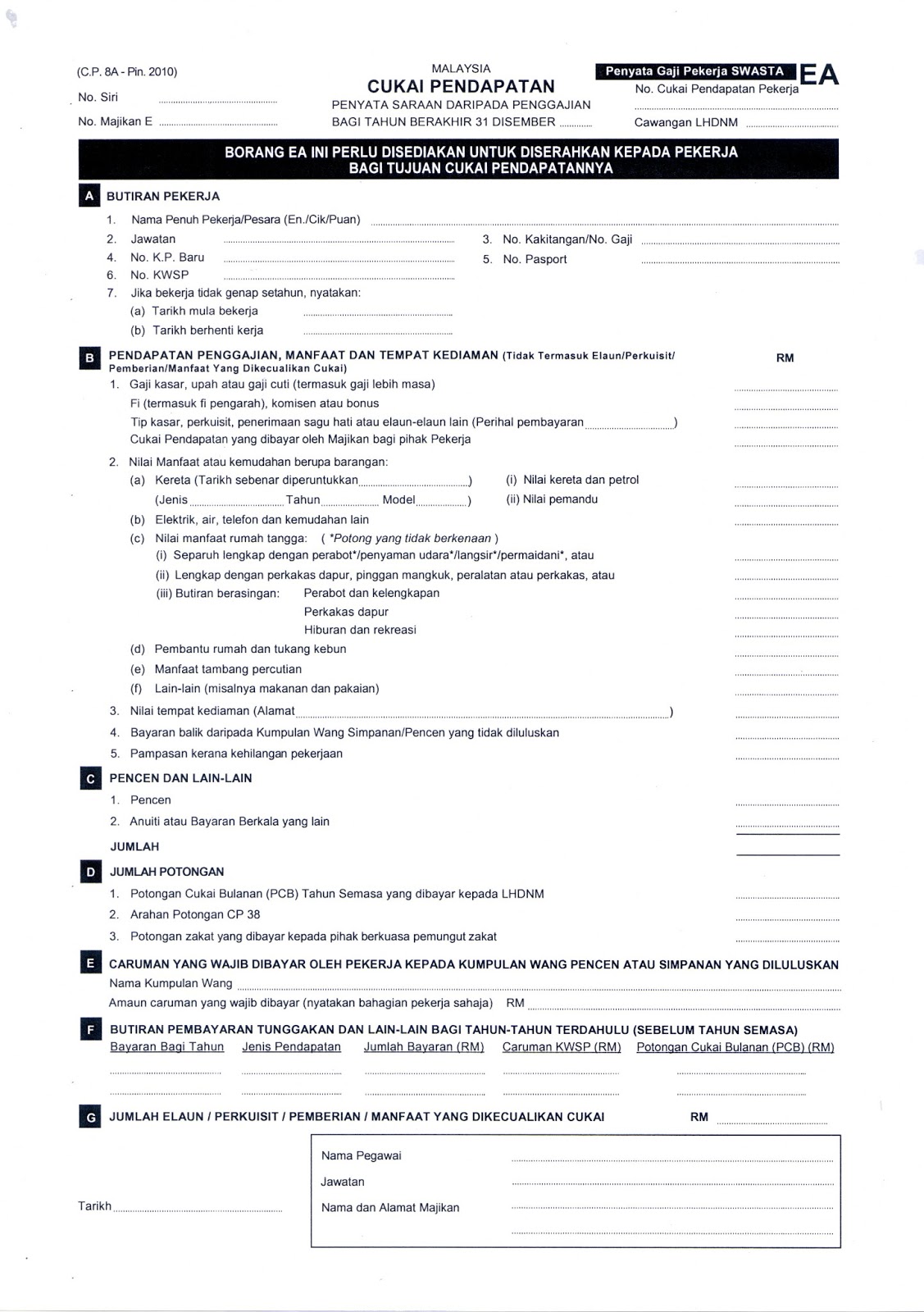

Ea form borang c p 8a overview in accordance with subsection 83 1a of the income tax act 1967 ita 1967 the form c p 8a c p 8c must be prepared and rendered to the employees on or before end of february the following year to enable them to complete and submit their respective return form within the stipulated period. Borang m mt e m e mt borang nyata. Program memfail borang nyata bn bagi tahun 2020. Employers form e by 31 march 2017.

Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015. No cause of business income. The due dates for submission are as follow. Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form.