Borang Pcb Tp3 English

Borang tp3 for new company.

Borang pcb tp3 english. Borang pcb tp3 1 2017 bahagian a. Mtd 2016 testing question. Income tax deduction from remuneration amendment no. Fri 21 jun 2019 11 14 51 pm i will be joining new company on july 2019.

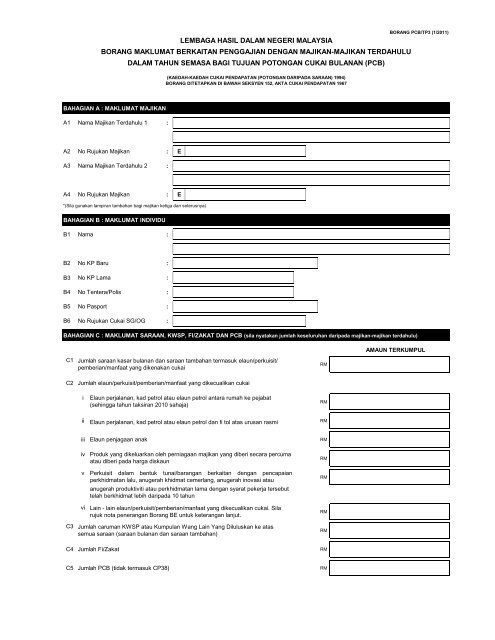

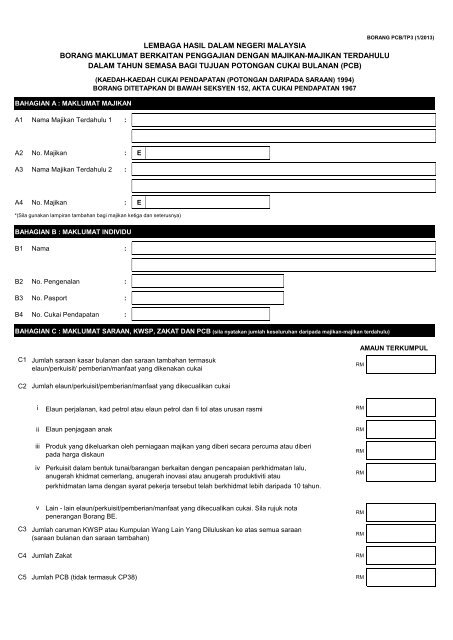

Exhibit 1 borang pcb tp3 1 2015 bahagian a. 2020 01 30 16 01 48 headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Maklumat saraan kwsp fi zakat dan pcb sila nyatakan jumlah keseluruhan daripada majikan majikan terdahulu c1. 4 wed 29 may 2019 09 45 35 pm last updated.

New company require me to fill up borang tp3. Form pcb tp3 1 2020 previous employer employment information in current year for mtd purpose claim form. Program memfail borang nyata bn bagi tahun 2020. Borang pcb tp3 1 2010 bahagian c.

Borang pcb tp3 1 2019 lembaga hasil dalam negeri malaysia borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 acp. E a3 nama majikan terdahulu 2. Tp3 as per malaysia inland revenue board irb requirement employee who newly joined the company during the year shall submit tp3 form to his her new employer to notify information relating to his. Maklumat majikan a1 nama majikan terdahulu 1.

Lembaga hasil dalam negeri malaysia. Jumlah saraan kasar bulanan dan saraan tambahan termasuk elaun perkuisit pemberian manfaat yang dikenakan cukai. Form pcb tp3 1 2015 previous employer employment information in current yearfor mtd purpose claim form. Maklumat majikan a1 nama majikan terdahulu 1.

E sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020. Borang pcb tp3 1 2015 inland revenue board of malaysia irbm form for previous employment remuneration information in current year for monthly tax deduction mtd purposes kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967.