Borang Tp1 2017 English Version

Pengenalan lembaga hasil dalam negeri malaysia terhad rm5 000 no.

Borang tp1 2017 english version. Borang pcb tp1 1 2010 bulan potongan. Guidelines for monthly tax deduction under income tax deduction from remuneration amendment no. Maklumat individu bahagian c. Maklumat majikan a1 nama majikan.

The due dates for submission are as follow. Maklumat individu b1 nama. With tp1 submission you have basically claimed your tax reliefs and therefore your pcb paid would equal to total tax payable. B2 no kp baru.

A2 no rujukan majikan. Borang pcb tp1 1 2015 bahagian a. Borang pcb tp1 2020. E bahagian b.

Form pcb tp1 1 2015 individual deduction and rebate claim form. Maklumat individu bahagian c. To make the claim you have to download and fill in the form pcb tp1 of the lembaga hasil dalam negeri lhdn or the inland revenue board of malaysia. B7 no pekerja no gaji.

Borang pcb tp1 2020. Employers form e by 31 march 2017. English version garis panduan kkcp pind 2015. When you are paying your monthly income tax deduction or potongan cukai bulanan pcb you have the option to make claim of the deduction and rebate for an individual.

The 2016 assessment year goes according to the calendar year meaning you will be filing your income tax return forms for 1 january 2016 to 31 december 2016. Maklumat potongan nama no. Kkcp pind 2019. B3 no kp lama.

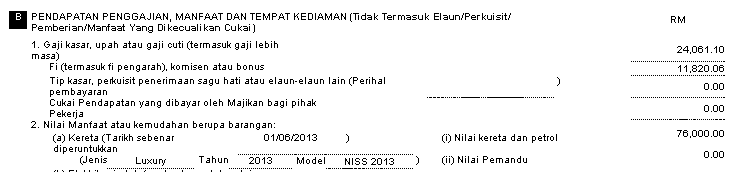

Maklumat majikan bahagian b. Borang pcb tp1 1 2017 c6 rm c7 rm rm c8 rm rm c9 insurans pendidikan dan perubatan rm rm c10 rm rm c11 rm rm c12 rm rm c13 rm rm c14 rm rm c15 rm rm d1 zakat selain yang dibayar melalui potongan daripada gaji bulanan rm tarikh bulan permohonan tuntutan pekerja di atas adalah dipersetujui bagi bulan potongan tahun potongan. Maklumat potongan nama lembaga hasil dalam negeri malaysia borang tuntutan potongan dan rebat individu nama majikan no. Residents and non residents with non business income form be and m by 30 april continue reading borang tp 1 tax release form.

Borang pcb tp3 2020. 2 rules 2015 in malay version only lampiran a table monthly tax deduction 2016 specification for mtd calculation using computerised calculation for 2016. Gaji nama majikan no. B6 no rujukan cukai sg og.

Majikan bagi tujuan potongan cukai bulanan pcb bulan semasa kaedah kaedah cukai pendapatan potongan daripada saraan 1994. Pernah bekerja sebelum ini dalam tahun semasa. Borang pcb tp1 1 2016 bahagian a.