Submit Borang E 2019

Lanjutan daripada itu pengeluaran stokc juga akan diberhentikan.

Submit borang e 2019. Ta ta e ta trust bodies 1 august 2019 3. In i ncome tax 2019 e filing lhdn known as electronic filing is the powerful tool that can deliver significant social and economic benefit based on payroll malaysia. Pt pt e pt limited liability partnerships within 7 months from the date. 1 2019 cp8 pin.

Or company registration number then click proceed. Jika pembayar cukai mengemukakan borang be tahun taksiran 2019 secara e filing e be pada 16 mei 2020 bncp tersebut akan dianggap sebagai lewat diterima mulai 1 mei 2020 dan boleh dikenakan penalti di bawah subseksyen 112 3 acp 1967. C e c companies 9. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019.

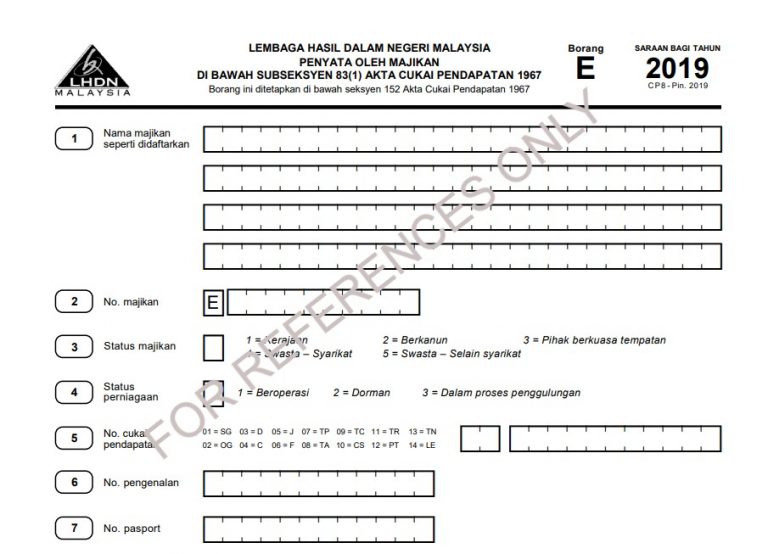

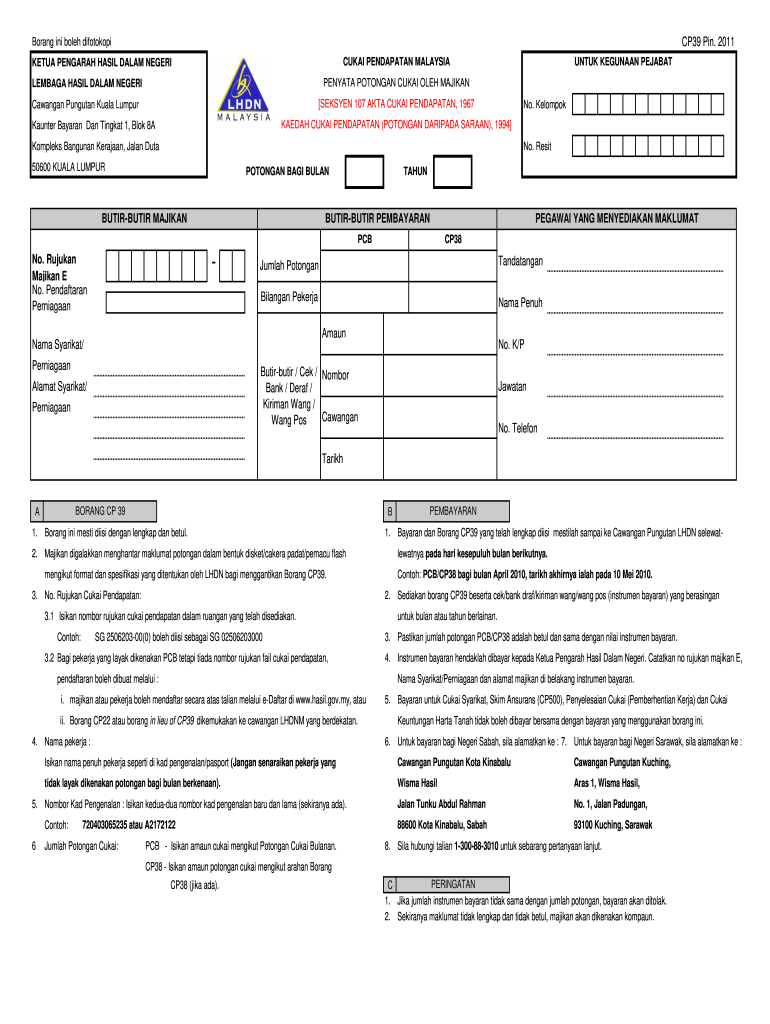

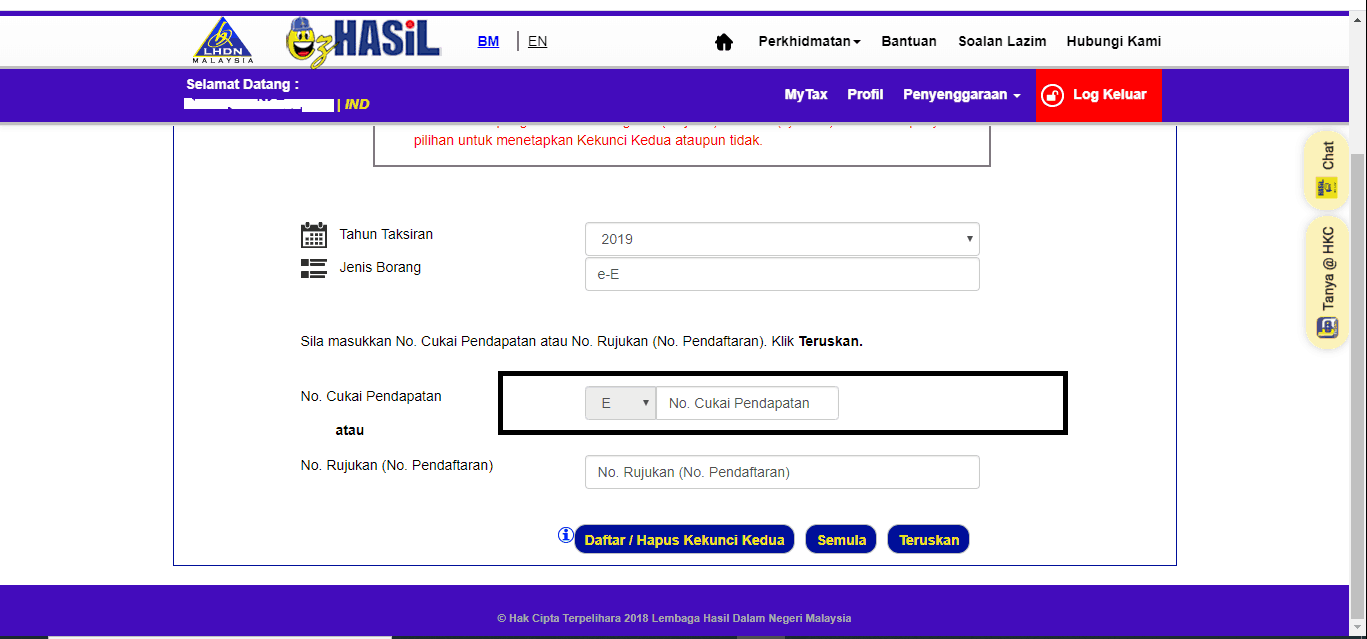

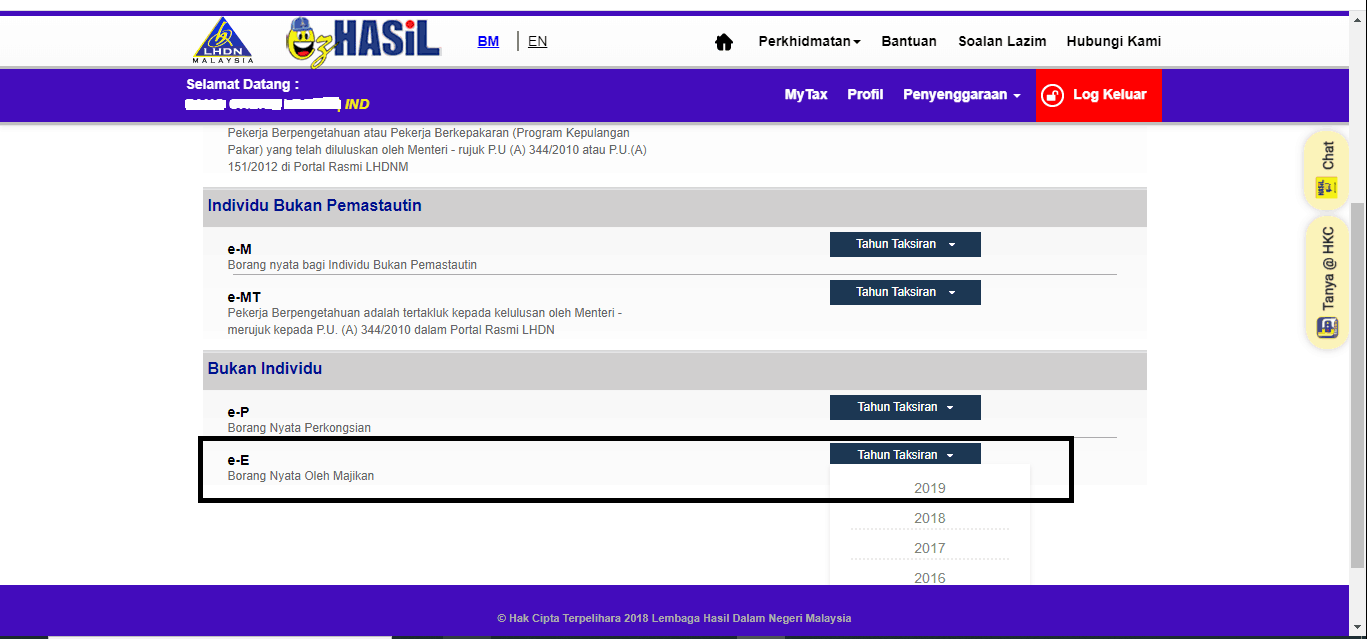

2019 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e. Fill in your company details and select muat naik c p 8d in the dropdown. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Select form type e e and input your income tax no.

Tambahan masa diberikan sehingga 15 mei 2020 bagi e filing borang be e be tahun taksiran 2019. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019 melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. E borang e permohonan pindaan be. The major advantage of e filing lhdn income tax 2019 is includes the ease of use technology reduction in rush and saves the time when user do submission income tax 2019 through online.

Program memfail borang nyata bn bagi tahun 2019 pindaan 4 2019 contoh format baucar dividen. Nama 5 7 negeri no. J tj hindu joint families 15 july 2019 4. On and before 30 4 2020.

How to use lhdn e filing platform to file e form borang e to lhdn all employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. Companies co operative societies limited liability partnerships and trust bodies return for the year of assessment 2019 1. Failure to do so will result in the irb taking legal action against the company s director. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc.

E c1 co operative societies 1 august 2019 c.