Borang Pcb Tp1 How To Fill Up

Fill in the amount of tax deduction according to the cp38 form.

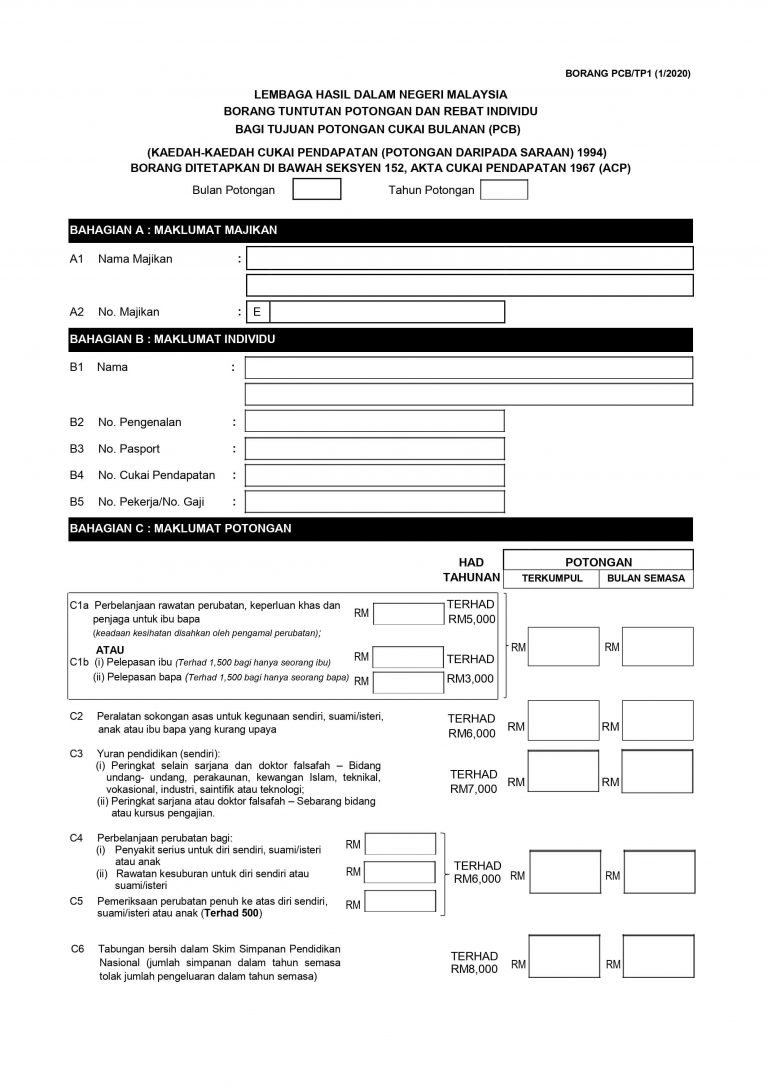

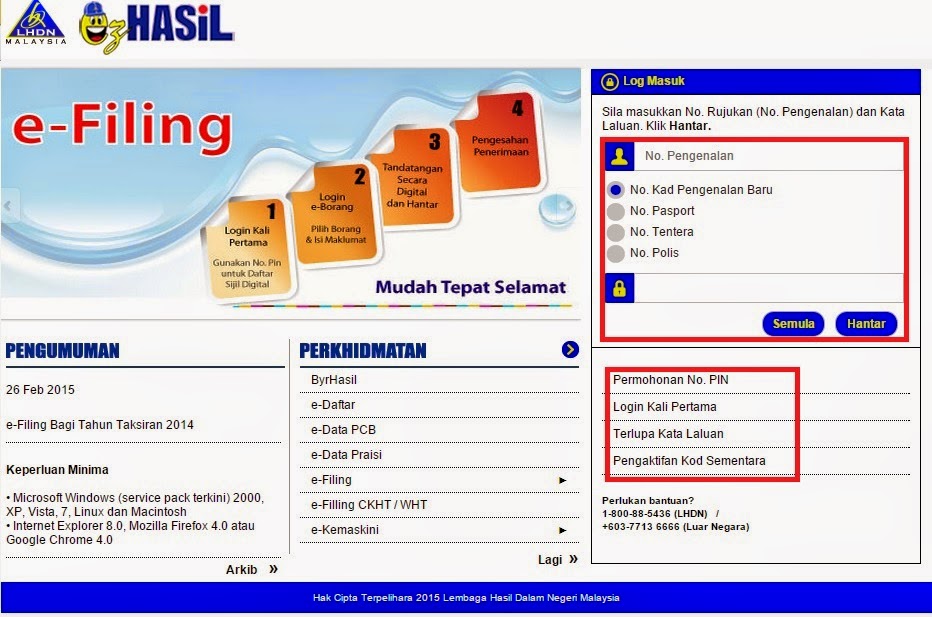

Borang pcb tp1 how to fill up. If there is no deduction leave this item blank. Majikan borang tuntutan potongan dan rebat individu bagi tujuan potongan cukai bulanan pcb. Pengenalan lembaga hasil dalam negeri malaysia terhad rm5 000 no. With tp1 submission you have basically claimed your tax reliefs and therefore your pcb paid would equal to total tax payable.

The purchase can be made in complete set or separate parts. But i already submit be form for year 2018. Borang pcb tp1 1 2019 lembaga hasil dalam negeri malaysia borang tuntutan potongan dan rebat individu bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 acp. Maklumat individu bahagian c.

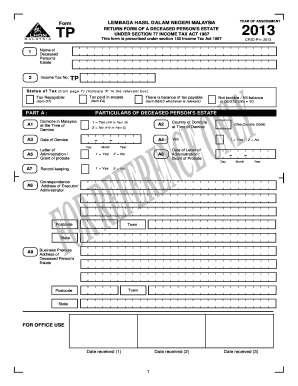

Hi my new company hr asked me to fill up a form of my total gross salary pcb amp. Deduction for month year fill in month and year using numbers only. Borang pcb tp3 1 2010 lembaga hasil dalam negeri malaysia borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967. Or i would need to declare for last year 2018 as well.

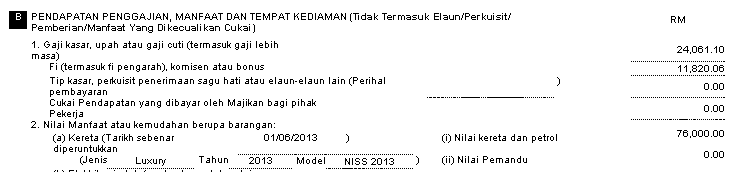

Maklumat potongan nama no. Borang pcb tp1 1 2015 bahagian a. Filling up form cp39a arrears payment for prior years received in current year this information enables you to fill the form correctly. Maklumat majikan bahagian b.

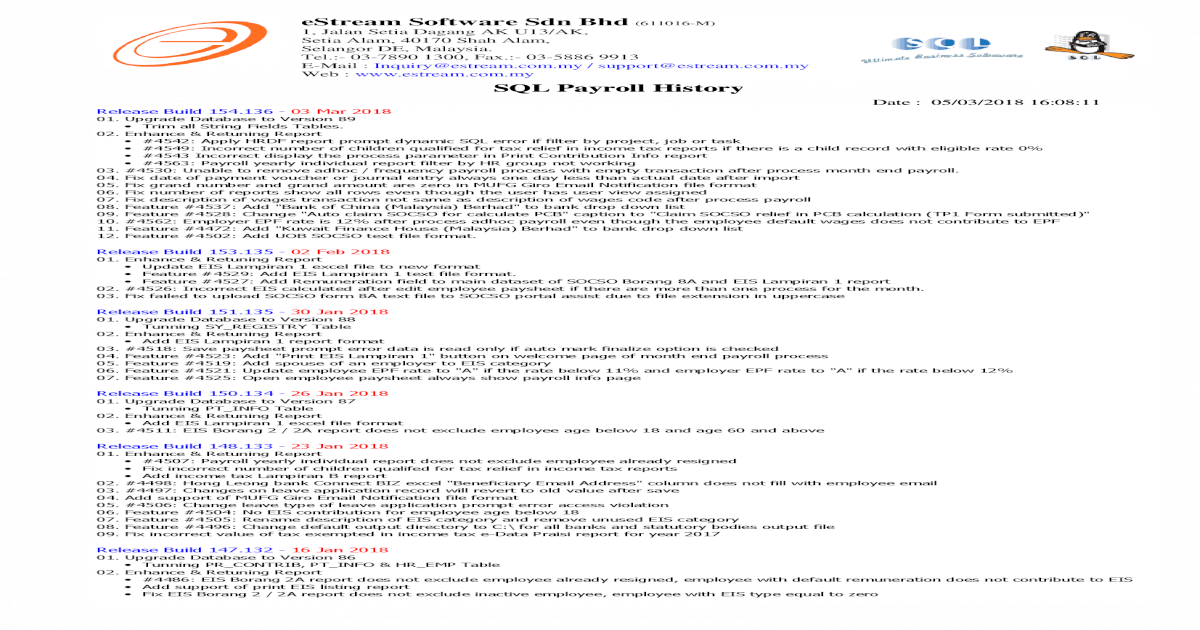

I will be joining new company on july 2019. New company require me to fill up borang tp3. Borang pcb tp1 1 2017 c6 rm c7 rm rm c8 rm rm c9 insurans pendidikan dan perubatan rm rm c10 rm rm c11 rm rm c12 rm rm c13 rm rm c14 rm rm c15 rm rm d1 zakat selain yang dibayar melalui potongan daripada gaji bulanan rm tarikh bulan permohonan tuntutan pekerja di atas adalah dipersetujui bagi bulan potongan tahun potongan. Gaji nama majikan no.

Total epf of my previous companies. Do i only need to declare my income pcb from jan 2019 until june 2019 for old company current company. Tax deduction for fees paid to child care centres and kindergartens a limit of up to rm1 000 new section 46 1 r income tax act 1967. To make the claim you have to download and fill in the form pcb tp1 of the lembaga hasil dalam negeri lhdn or the inland revenue board of malaysia.

Since when my new company hr need to know about this thank you. The new tax deduction is applicable to working women with child aged up to 2 years and can be claimed once every 2 years.